![]()

![]() On Sunday November 15, fifteen countries from the Asia-Pacific region including China, Australia, Japan and South Korea signed the Regional Comprehensive Economic Partnership (RCEP), forming the world’s biggest trade block. The deal plans to eliminate tariffs on 90% of products traded between members.

On Sunday November 15, fifteen countries from the Asia-Pacific region including China, Australia, Japan and South Korea signed the Regional Comprehensive Economic Partnership (RCEP), forming the world’s biggest trade block. The deal plans to eliminate tariffs on 90% of products traded between members.

![]() Japan annualised GDP for Q3 was revealed on Sunday, showing a record rebound of 21.4% QoQ, beating the market expectation of 18.9%.

Japan annualised GDP for Q3 was revealed on Sunday, showing a record rebound of 21.4% QoQ, beating the market expectation of 18.9%.

![]() Moderna announced its COVID-19 vaccine efficacy on Monday November 16, which is estimated to be 94.5% effective and more importantly, it can be stored at standard refrigerator temperatures up to 30 days while the vaccine developed by Pfizer and BioNTech requires to be refrigerated at -70 to -80 degrees.

Moderna announced its COVID-19 vaccine efficacy on Monday November 16, which is estimated to be 94.5% effective and more importantly, it can be stored at standard refrigerator temperatures up to 30 days while the vaccine developed by Pfizer and BioNTech requires to be refrigerated at -70 to -80 degrees.

![]() On Thursday November 19, the US initial jobless claims data in the week ending November 14 was published, unexpectedly rising by 31,000 to 742,000, worse than the expectations. Meanwhile, the US October retail sales released on Tuesday November 17 shows that the sector was expanding at the slowest pace in six months, at 0.3% MoM. Both labour market and retail sales are impacted by the tighter Covid restrictions in the US.

On Thursday November 19, the US initial jobless claims data in the week ending November 14 was published, unexpectedly rising by 31,000 to 742,000, worse than the expectations. Meanwhile, the US October retail sales released on Tuesday November 17 shows that the sector was expanding at the slowest pace in six months, at 0.3% MoM. Both labour market and retail sales are impacted by the tighter Covid restrictions in the US.

![]()

![]()

![]() On Monday November 23, Markit Eurozone Composite PMI will be released and is expected to come in at 45.6.

On Monday November 23, Markit Eurozone Composite PMI will be released and is expected to come in at 45.6.

![]() UK Markit Services PMI will be revealed on the same day, Monday November 23, and is expected to come in at 43.0.

UK Markit Services PMI will be revealed on the same day, Monday November 23, and is expected to come in at 43.0.

![]()

-0.07*

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 31/10/20

Notice:

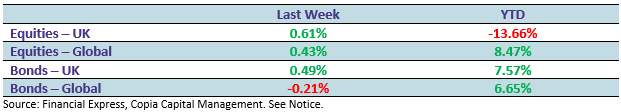

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.