![]()

![]() On Wednesday October 14, the International Monetary Fund (IMF) revised its global economic forecasts for 2020, seeing the world economy down by 4.4% in 2020, improved from previous prediction of 5.2%, and it expects the world economy to grow 5.2% in 2021 providing that the fiscal and monetary stimulus will stay in place.

On Wednesday October 14, the International Monetary Fund (IMF) revised its global economic forecasts for 2020, seeing the world economy down by 4.4% in 2020, improved from previous prediction of 5.2%, and it expects the world economy to grow 5.2% in 2021 providing that the fiscal and monetary stimulus will stay in place.

![]() On Thursday October 15, the US initial jobless claims data in the week ending October 10 was published, unexpectedly rising by 53,000 to 898,000 while the markets predicted it to decline compared to the previous week’s data.

On Thursday October 15, the US initial jobless claims data in the week ending October 10 was published, unexpectedly rising by 53,000 to 898,000 while the markets predicted it to decline compared to the previous week’s data.

![]() The post-Brexit trade talks made little progress after negotiations on Thursday. Boris Johnson asserted on Friday October 16 that the country should now start getting ready for a no-deal Brexit. Trade talks will continue next week according the EC President Ursula von der Leyen.

The post-Brexit trade talks made little progress after negotiations on Thursday. Boris Johnson asserted on Friday October 16 that the country should now start getting ready for a no-deal Brexit. Trade talks will continue next week according the EC President Ursula von der Leyen.

![]() On Friday, the daily increase of new Covid infections at a global level reached a record high with almost 400,000 new cases added. In Europe, Germany and France reported new high in daily jumps. France introduced the 9pm curfew in major cities and several cities in the UK including London will be under tighter Tier 2 Covid measures from Saturday October 17.

On Friday, the daily increase of new Covid infections at a global level reached a record high with almost 400,000 new cases added. In Europe, Germany and France reported new high in daily jumps. France introduced the 9pm curfew in major cities and several cities in the UK including London will be under tighter Tier 2 Covid measures from Saturday October 17.

![]()

![]()

![]() China GDP growth will be released on Monday October 19, at an expected rate of 5.5% YoY.

China GDP growth will be released on Monday October 19, at an expected rate of 5.5% YoY.

![]() UK CPI for September will be announced on Wednesday October 21, with an expectation of 0.6% YoY.

UK CPI for September will be announced on Wednesday October 21, with an expectation of 0.6% YoY.

![]()

-0.19*

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 30/09/20

Notice:

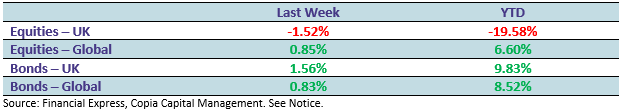

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.