![]()

![]() The new $500 billion coronavirus bill failed to pass the US Senate vote on Thursday September 10 as all Senate Democrats and one Republican voted against it. The bill mostly advocated by Republicans, is at a smaller scale compared to the previous aid package, which expired at the end of July. The Democrats find the new bill inadequate as it does not address many pressing issues.

The new $500 billion coronavirus bill failed to pass the US Senate vote on Thursday September 10 as all Senate Democrats and one Republican voted against it. The bill mostly advocated by Republicans, is at a smaller scale compared to the previous aid package, which expired at the end of July. The Democrats find the new bill inadequate as it does not address many pressing issues.

![]() On Thursday September 10, ECB decided to maintain the benchmark interest rate at 0%, with the marginal lending facility and the deposit facility rates at 0.25% and -0.50% respectively. The rates will be kept at current or lower levels until the inflation outlook improves close to the 2% target. The bank will continue its asset purchases under the Pandemic Emergency Purchase Programme worth €1.35 trillion.

On Thursday September 10, ECB decided to maintain the benchmark interest rate at 0%, with the marginal lending facility and the deposit facility rates at 0.25% and -0.50% respectively. The rates will be kept at current or lower levels until the inflation outlook improves close to the 2% target. The bank will continue its asset purchases under the Pandemic Emergency Purchase Programme worth €1.35 trillion.

![]() EU on Thursday gave UK a deadline by the end of this month to withdraw the Internal Market Bill, which overrides parts of the Brexit Withdrawal Agreement and breaks the international law.

EU on Thursday gave UK a deadline by the end of this month to withdraw the Internal Market Bill, which overrides parts of the Brexit Withdrawal Agreement and breaks the international law.

![]() Europe saw new peaks in coronavirus infections last week. The UK R number now stands between 1 and 1.2, indicating that the infections are spreading fast. On Thursday, France reported a record jump in daily infections at 9,843 and Germany also showed a rising rate in new cases over last week.

Europe saw new peaks in coronavirus infections last week. The UK R number now stands between 1 and 1.2, indicating that the infections are spreading fast. On Thursday, France reported a record jump in daily infections at 9,843 and Germany also showed a rising rate in new cases over last week.

![]()

![]()

![]() UK unemployment rate will be released on Tuesday September 15, expected at 4.1%.

UK unemployment rate will be released on Tuesday September 15, expected at 4.1%.

![]() UK CPI for August will be announced on Wednesday September 16, with an expectation of 0.1% YoY.

UK CPI for August will be announced on Wednesday September 16, with an expectation of 0.1% YoY.

![]()

-0.40*

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 30/08/20

Notice:

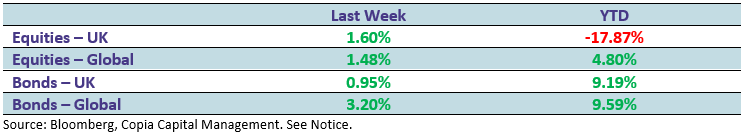

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.