![]()

![]() On Monday August 17, the Japan GDP for the second quarter of 2020 was published, showing a record drop of 27.8% YoY and 7.8% compared to 1Q20, with exports falling 18.5% QoQ. The Japan Manufacturing PMI for August however showed signs of recovery, improved by 1.4 points from July, landing at 46.6, the highest since March 2020.

On Monday August 17, the Japan GDP for the second quarter of 2020 was published, showing a record drop of 27.8% YoY and 7.8% compared to 1Q20, with exports falling 18.5% QoQ. The Japan Manufacturing PMI for August however showed signs of recovery, improved by 1.4 points from July, landing at 46.6, the highest since March 2020.

![]() On Wednesday August 19, the US Fed released July’s meeting minutes. The policymakers confirmed they will stick to the monetary policies that have been decided and are discussing the possible changes to the Committee’s statement on long-term goals, considering the longer-than-expected economic impact of Covid-19 and the persistent disinflationary pressures over the past decade.

On Wednesday August 19, the US Fed released July’s meeting minutes. The policymakers confirmed they will stick to the monetary policies that have been decided and are discussing the possible changes to the Committee’s statement on long-term goals, considering the longer-than-expected economic impact of Covid-19 and the persistent disinflationary pressures over the past decade.

![]() The Eurozone Manufacturing and Services PMIs for August were published last week. The Service PMI plunged from 54.7 to 50.1 and Manufacturing PMI fell slightly from 51.8 to 51.7, both below the market expectations, mainly affected by the resurgence of Covid infections.

The Eurozone Manufacturing and Services PMIs for August were published last week. The Service PMI plunged from 54.7 to 50.1 and Manufacturing PMI fell slightly from 51.8 to 51.7, both below the market expectations, mainly affected by the resurgence of Covid infections.

![]() The US initial jobless claims rose in the week ending August 14, with an increase of 135,000 in the number of people filing for unemployment benefits, missing the market estimates which expected a drop compared to the previous week.

The US initial jobless claims rose in the week ending August 14, with an increase of 135,000 in the number of people filing for unemployment benefits, missing the market estimates which expected a drop compared to the previous week.

![]()

![]()

![]() The US Conference Board Consumer Confidence indicator will be published on Tuesday August 25, with an expectation of 93.0 for the month of August.

The US Conference Board Consumer Confidence indicator will be published on Tuesday August 25, with an expectation of 93.0 for the month of August.

![]() Germany IFO Business Climate index will be published on the Tuesday August 25, expected at 92.4.

Germany IFO Business Climate index will be published on the Tuesday August 25, expected at 92.4.

![]()

-0.45*

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 17/08/20

Notice:

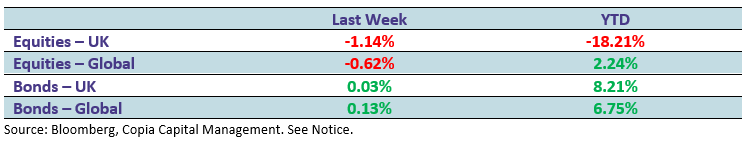

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.