![]()

![]() Last week, UK imposed the 14-day quarantine rules on people returning from Belgium and Spain to the UK due the jump in coronavirus infections in two countries. Globally, the confirmed Covid-19 cases has climbed over 19 million last week.

Last week, UK imposed the 14-day quarantine rules on people returning from Belgium and Spain to the UK due the jump in coronavirus infections in two countries. Globally, the confirmed Covid-19 cases has climbed over 19 million last week.

![]() On Thursday August 6, BoE decided to keep its benchmark rate unchanged at 0.1% and to keep the extended bond-buying programme at the same level of £745bn. The Bank warned that the UK economic outlook will critically depend on the development of Covid-19 and estimated that the UK GDP will remain below the pre-pandemic level until the end of 2021.

On Thursday August 6, BoE decided to keep its benchmark rate unchanged at 0.1% and to keep the extended bond-buying programme at the same level of £745bn. The Bank warned that the UK economic outlook will critically depend on the development of Covid-19 and estimated that the UK GDP will remain below the pre-pandemic level until the end of 2021.

![]() Also on Thursday, Trump signed two executive orders targeting Chinese tech firms ByteDance and Tencent, which will impose sanctions against any US entities doing businesses with either of the Chinese firms, starting in 45 days. TikTok and WeChat, the most popular apps of ByteDance and Tencent were accused by Trump of threatening the US national security. Tencent share price plunged more than 10% following the announcement.

Also on Thursday, Trump signed two executive orders targeting Chinese tech firms ByteDance and Tencent, which will impose sanctions against any US entities doing businesses with either of the Chinese firms, starting in 45 days. TikTok and WeChat, the most popular apps of ByteDance and Tencent were accused by Trump of threatening the US national security. Tencent share price plunged more than 10% following the announcement.

![]() On Friday August 7, US nonfarm payrolls data was published, showing an employment increase of 1.76 million in July, higher than the estimates of 1.48 million. The US unemployment rate decreased by 0.9%, standing at 10.2%.

On Friday August 7, US nonfarm payrolls data was published, showing an employment increase of 1.76 million in July, higher than the estimates of 1.48 million. The US unemployment rate decreased by 0.9%, standing at 10.2%.

![]()

![]()

![]() China CPI will be announced on Monday August 10, with an expectation of 2.6% YoY.

China CPI will be announced on Monday August 10, with an expectation of 2.6% YoY.

![]() UK unemployment rate will be released on Tuesday August 11, expected at 4.2%.

UK unemployment rate will be released on Tuesday August 11, expected at 4.2%.

![]()

-0.47*

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 31/07/20

Notice:

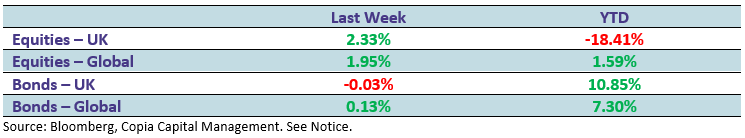

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.