![]()

![]() Last week, JPMorgan, Goldman Sachs and Morgan Stanley released earnings reports for Q2. JPMorgan reported its revenue at $33.82 billion, 14% higher compared to the same period last year while its earnings per share (EPS) fell 47% YoY to $1.38 but still topped the market estimates. Compared to Q2 2019, Goldman Sachs’ EPS unexpectedly rose 7.7% YoY to $6.26 and total revenue jumped 41% to $13.3 billion. Morgan Stanley also reported a strong growth in revenue by 31% YoY to $13.4 billion and EPS was up by 66% YoY, standing at $2.04.

Last week, JPMorgan, Goldman Sachs and Morgan Stanley released earnings reports for Q2. JPMorgan reported its revenue at $33.82 billion, 14% higher compared to the same period last year while its earnings per share (EPS) fell 47% YoY to $1.38 but still topped the market estimates. Compared to Q2 2019, Goldman Sachs’ EPS unexpectedly rose 7.7% YoY to $6.26 and total revenue jumped 41% to $13.3 billion. Morgan Stanley also reported a strong growth in revenue by 31% YoY to $13.4 billion and EPS was up by 66% YoY, standing at $2.04.

![]() Trump administration revealed on Monday that the US health officials and drugmakers plan to put a still-unknown coronavirus vaccine into mass production in four to six weeks and aims to deliver 300 million vaccine doses by early 2021. On Friday July 17, Boris Johnson confirmed that the UK government will allocate an additional £3 billion to NHS in preparation for the potential second wave of coronavirus pandemic in Winter.

Trump administration revealed on Monday that the US health officials and drugmakers plan to put a still-unknown coronavirus vaccine into mass production in four to six weeks and aims to deliver 300 million vaccine doses by early 2021. On Friday July 17, Boris Johnson confirmed that the UK government will allocate an additional £3 billion to NHS in preparation for the potential second wave of coronavirus pandemic in Winter.

![]() On Thursday July 16 ECB decided to maintain the benchmark interest rate at 0%, the marginal lending facility and the deposit facility rates at 0.25% and -0.5% respectively. The bank will continue its asset purchases under the Pandemic Emergency Purchase Programme worth €1.35 trillion.

On Thursday July 16 ECB decided to maintain the benchmark interest rate at 0%, the marginal lending facility and the deposit facility rates at 0.25% and -0.5% respectively. The bank will continue its asset purchases under the Pandemic Emergency Purchase Programme worth €1.35 trillion.

![]() US-China tensions escalated further last week over the Hong Kong and South China Sea disputes. The US passed the bill of sanctions against Chinese officials over the Hong Kong national security law. Meanwhile, the US Department of State issued a statement denouncing China’s territorial claims in the South China Sea, calling it completely unlawful and the US may impose further sanctions against China.

US-China tensions escalated further last week over the Hong Kong and South China Sea disputes. The US passed the bill of sanctions against Chinese officials over the Hong Kong national security law. Meanwhile, the US Department of State issued a statement denouncing China’s territorial claims in the South China Sea, calling it completely unlawful and the US may impose further sanctions against China.

![]()

![]()

![]() Japan CPI will be announced on Tuesday July 21, with an expectation of 0.00% YoY.

Japan CPI will be announced on Tuesday July 21, with an expectation of 0.00% YoY.

![]() On Friday July 24, Eurozone Composite PMI will be released and is expected to come in at 59.

On Friday July 24, Eurozone Composite PMI will be released and is expected to come in at 59.

![]()

-0.50*

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 30/06/20

Notice:

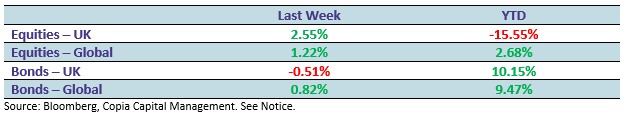

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.