![]()

![]() On Saturday June 6, the OPEC+ decided to extend oil production cuts of 9.7mn barrels per day through July to stabilise global oil market. The production cuts were initially agreed to be reduced from 9.7mn to 7.7mn barrels per day from July to the end of 2020.

On Saturday June 6, the OPEC+ decided to extend oil production cuts of 9.7mn barrels per day through July to stabilise global oil market. The production cuts were initially agreed to be reduced from 9.7mn to 7.7mn barrels per day from July to the end of 2020.

![]() The US Fed announced on Wednesday June 10 that the target range for the federal funds rate will remain unchanged at 0.00-0.25%, and is unlikely to hike at least until 2022. The chairman Jerome Powell estimated that the US GDP for the second quarter may be most severe on record and the economy may need further financial support.

The US Fed announced on Wednesday June 10 that the target range for the federal funds rate will remain unchanged at 0.00-0.25%, and is unlikely to hike at least until 2022. The chairman Jerome Powell estimated that the US GDP for the second quarter may be most severe on record and the economy may need further financial support.

![]() Dow Jones plunged 6.9% on Thursday due to rising concerns over the second outbreak of coronavirus after several states in US reported accelerating infections and the Fed’s warnings on a prolonged economic damage caused by the Covid-19 added more uncertainties.

Dow Jones plunged 6.9% on Thursday due to rising concerns over the second outbreak of coronavirus after several states in US reported accelerating infections and the Fed’s warnings on a prolonged economic damage caused by the Covid-19 added more uncertainties.

![]() The UK GDP growth for April was published on Friday June 12, showing a record monthly contraction of 20.4% and the GDP in three months ending April slumped 10.4%. Affected by the lockdown, the construction sector shrank 18.2% in three months, and the services sector went down by 9.9%.

The UK GDP growth for April was published on Friday June 12, showing a record monthly contraction of 20.4% and the GDP in three months ending April slumped 10.4%. Affected by the lockdown, the construction sector shrank 18.2% in three months, and the services sector went down by 9.9%.

![]()

![]()

![]() UK CPI will be announced on Wednesday June 17, with an expectation of 0.50% YoY.

UK CPI will be announced on Wednesday June 17, with an expectation of 0.50% YoY.

![]() BoE will announce interest rate decision on Thursday June 18, which is expected to stay at 0.10%.

BoE will announce interest rate decision on Thursday June 18, which is expected to stay at 0.10%.

![]()

-0.74*

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 31/05/2020

Notice:

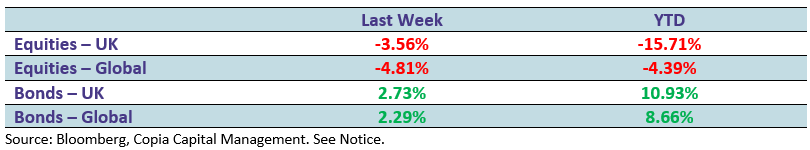

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.