![]()

![]() The US Fed announced on Wednesday April 29 that the target range for the federal funds rate will remain unchanged at 0.00-0.25%, adding that it will be kept at this level until the US economy recovers. The ECB announced their rate decisions on Thursday April 30, leaving the benchmark interest rate unchanged at 0% and the base deposit rate at -0.5%.

The US Fed announced on Wednesday April 29 that the target range for the federal funds rate will remain unchanged at 0.00-0.25%, adding that it will be kept at this level until the US economy recovers. The ECB announced their rate decisions on Thursday April 30, leaving the benchmark interest rate unchanged at 0% and the base deposit rate at -0.5%.

![]() Last week, US major tech companies including Alphabet, Facebook and Amazon released earnings reports for Q1. Alphabet reported its revenue at $41.16 billion, 13% higher compared to the same period last year whereas EPS slid slightly to $9.87. Compared to the Q1 2019, Facebook’s EPS went up 101% to $1.71 and total revenue jumped by 18% to $17.74 billion. Amazon also reported an increase in revenue by 26% YoY to $75.5 billion while EPS was down by 45% YoY, standing at $5.01.

Last week, US major tech companies including Alphabet, Facebook and Amazon released earnings reports for Q1. Alphabet reported its revenue at $41.16 billion, 13% higher compared to the same period last year whereas EPS slid slightly to $9.87. Compared to the Q1 2019, Facebook’s EPS went up 101% to $1.71 and total revenue jumped by 18% to $17.74 billion. Amazon also reported an increase in revenue by 26% YoY to $75.5 billion while EPS was down by 45% YoY, standing at $5.01.

![]() US GDP for Q1 2020 was published on Wednesday, plunging 4.8% YoY, marking the biggest contraction since 2009 due to the coronavirus impact. The US Markit Manufacturing PMI also saw a record decline in April, standing at 36.1, falling from 48.5 in March.

US GDP for Q1 2020 was published on Wednesday, plunging 4.8% YoY, marking the biggest contraction since 2009 due to the coronavirus impact. The US Markit Manufacturing PMI also saw a record decline in April, standing at 36.1, falling from 48.5 in March.

![]() The confirmed coronavirus cases in the US surpassed 1 million on Wednesday while the number of new cases is increasing at the slowest pace of the month. The US has planned to ease the lockdown restrictions from May 1 and Trump expressed on Wednesday that he has no intention to extend the social distancing guidelines.

The confirmed coronavirus cases in the US surpassed 1 million on Wednesday while the number of new cases is increasing at the slowest pace of the month. The US has planned to ease the lockdown restrictions from May 1 and Trump expressed on Wednesday that he has no intention to extend the social distancing guidelines.

![]()

![]()

![]() On Monday May 4, China Manufacturing PMI will be released and is expected to come in at 50.3.

On Monday May 4, China Manufacturing PMI will be released and is expected to come in at 50.3.

![]() BoE will announce interest rate decision on Thursday May 7 and is expected to keep the current rate unchanged at 0.10%.

BoE will announce interest rate decision on Thursday May 7 and is expected to keep the current rate unchanged at 0.10%.

![]()

-0.74*

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 30/04/20

Notice:

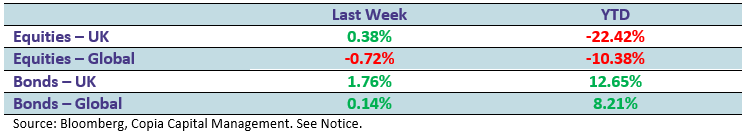

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.