![]()

![]() The WTI crude oil futures for May traded at negative prices on Monday April 20, one day before its expiration, due to the oil oversupply fears during the global lockdown period and high costs of storage and shipping. However, the WTI futures for June rallied after the drastic fall on Monday as the geopolitical tensions between Iran and the US escalated again.

The WTI crude oil futures for May traded at negative prices on Monday April 20, one day before its expiration, due to the oil oversupply fears during the global lockdown period and high costs of storage and shipping. However, the WTI futures for June rallied after the drastic fall on Monday as the geopolitical tensions between Iran and the US escalated again.

![]() With the lockdown continuing, the economic activities in US and Eurozone plunged sharply in April. The US Composite PMI dropped to 27.4 and services PMI down to 27.0. The Eurozone Composite PMI and services PMI both decreased to the record lows of 13.5 and 11.7 respectively.

With the lockdown continuing, the economic activities in US and Eurozone plunged sharply in April. The US Composite PMI dropped to 27.4 and services PMI down to 27.0. The Eurozone Composite PMI and services PMI both decreased to the record lows of 13.5 and 11.7 respectively.

![]() UK inflation in March slipped to 1.5% according the CPI published on Wednesday April 22, with the petrol and clothing prices falling the most.

UK inflation in March slipped to 1.5% according the CPI published on Wednesday April 22, with the petrol and clothing prices falling the most.

![]() The US House of Representatives passed the fourth stimulus package to fight the coronavirus. The package is worth $484 billion, aiming to extend the funding for Paycheck Protection Program and coronavirus testing at hospitals. In Europe, a recovery plan was finally agreed by EU leaders, which will mobilise investments worth €1 trillion, including a short-term financial support of €540 billion staring from June 1.

The US House of Representatives passed the fourth stimulus package to fight the coronavirus. The package is worth $484 billion, aiming to extend the funding for Paycheck Protection Program and coronavirus testing at hospitals. In Europe, a recovery plan was finally agreed by EU leaders, which will mobilise investments worth €1 trillion, including a short-term financial support of €540 billion staring from June 1.

![]()

![]()

![]() Eurozone GDP growth will be released on Thursday April 30, at an expected rate of -1.50% YoY.

Eurozone GDP growth will be released on Thursday April 30, at an expected rate of -1.50% YoY.

![]() Eurozone unemployment rate will be released on the same day, Thursday April 30, expected at 7.70%.

Eurozone unemployment rate will be released on the same day, Thursday April 30, expected at 7.70%.

![]()

-0.39*

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 20/04/20

Notice:

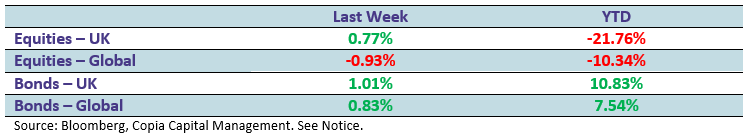

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.