![]()

![]() On Tuesday March 3, the US Fed cut the interest rate unexpectedly by 50bps due to coronavirus concerns, taking the federal funds target range down to 1%-1.25%. On Friday March 6, Trump signed an emergency spending bill that will allocate $8.3 billion to deal with the coronavirus crisis.

On Tuesday March 3, the US Fed cut the interest rate unexpectedly by 50bps due to coronavirus concerns, taking the federal funds target range down to 1%-1.25%. On Friday March 6, Trump signed an emergency spending bill that will allocate $8.3 billion to deal with the coronavirus crisis.

![]() With investors turning to safe-haven assets due to coronavirus fears, the US 10-year Treasury yield fell below 1% on Tuesday for the first time and hit another record low of 0.794% on Friday. Meanwhile, the price of Gold spiked, trading at $1,690 per ounce on Friday, the highest level since January 2013.

With investors turning to safe-haven assets due to coronavirus fears, the US 10-year Treasury yield fell below 1% on Tuesday for the first time and hit another record low of 0.794% on Friday. Meanwhile, the price of Gold spiked, trading at $1,690 per ounce on Friday, the highest level since January 2013.

![]() On Thursday March 5, OPEC agreed to cut crude oil output by 1.5 million barrels per day in response to the low oil demand amid coronavirus outbreak. However, the proposal was rejected by Russia at the OPEC+ meeting on Friday. Following the news, oil prices dropped more than 5% over uncertainties.

On Thursday March 5, OPEC agreed to cut crude oil output by 1.5 million barrels per day in response to the low oil demand amid coronavirus outbreak. However, the proposal was rejected by Russia at the OPEC+ meeting on Friday. Following the news, oil prices dropped more than 5% over uncertainties.

![]() On Friday, US nonfarm payrolls data was published, showing an employment increase of 273,000 in February, significantly higher than the estimates of 175,000. The unemployment rate remained at 3.5%.

On Friday, US nonfarm payrolls data was published, showing an employment increase of 273,000 in February, significantly higher than the estimates of 175,000. The unemployment rate remained at 3.5%.

![]()

![]()

![]() On Tuesday March 10, China CPI for January will also be announced, with an expectation of 4.90% YoY.

On Tuesday March 10, China CPI for January will also be announced, with an expectation of 4.90% YoY.

![]() Eurozone GDP growth will also be released on Tuesday March 10, at an expected rate of 0.90% YoY.

Eurozone GDP growth will also be released on Tuesday March 10, at an expected rate of 0.90% YoY.

![]()

+0.69*

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 28/02/2020

Notice:

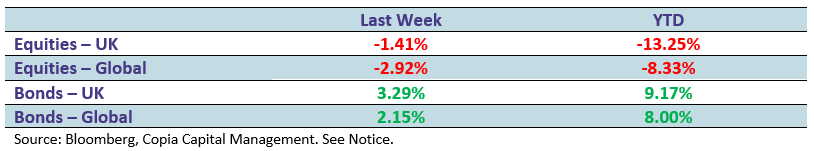

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.