![]()

- In the latest UK Budget, Chancellor Philip Hammond promised to fix the UK’s housing market by focusing on building more homes and cutting the level of stamp duty for first time buyers. Mr Hammond insisted the economy was “at a turning point” and he promised that the latest Budget would help create a “future that would be full of new opportunities”

- Federal Reserve officials expressed an optimistic view of US economic growth at their most recent meeting, but also stated concern that financial market prices are getting out of hand and posing a real danger to the economy. The committee has suggested to markets that they expect interest rates will have to be raised in the near-term, most likely leading to a rate hike in December

- Chinese stocks suffered their worst one-day sell-off in over 17 months, as investors cited rising bond yields and tough new regulations targeting corporate debt for pairing back their exposure to equities

- In what could be a potentially decisive U-turn, Germany’s Social Democrats look set to talk to their conservative rivals about the formation of a new government led by Angela Merkel, in what would be a welcome move to break the current political deadlock in Berlin

![]()

![]()

- On Wednesday 29 November we will see the release of US Chained GDP QoQ, with market expectations that this will come in at 3.2% for the third quarter

- On Friday 1 December we will see the release of UK Manufacturing PMI, with market expectations of an increase in the month of November to 56.5

![]() A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

![]() A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

![]() A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 13/11/17

Notice:

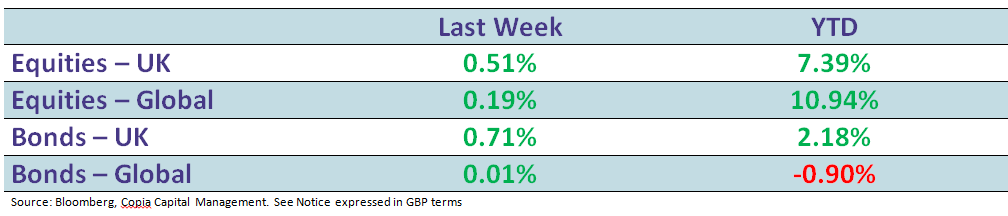

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.