![]()

![]() The Eurozone Composite PMI in June was released on Tuesday June 23, recorded at 47.5, beating the market expectation of 43.0. The PMI rebounded significantly from the record low in April at 13.6. The German, French and UK Composite PMIs all reached a 4-month high in June.

The Eurozone Composite PMI in June was released on Tuesday June 23, recorded at 47.5, beating the market expectation of 43.0. The PMI rebounded significantly from the record low in April at 13.6. The German, French and UK Composite PMIs all reached a 4-month high in June.

![]() On Wednesday June 24, the International Monetary Fund (IMF) cut its global economic forecasts for 2020 due to the coronavirus pandemic. The IMF revised the contraction in global GDP to 4.9% for this year, after previously predicting a 3% contraction. The GDP growth rate for 2021 was also lowered from 5.8% to 5.4%.

On Wednesday June 24, the International Monetary Fund (IMF) cut its global economic forecasts for 2020 due to the coronavirus pandemic. The IMF revised the contraction in global GDP to 4.9% for this year, after previously predicting a 3% contraction. The GDP growth rate for 2021 was also lowered from 5.8% to 5.4%.

![]() On Wednesday, the US announced that the Trump administration may impose tariffs on $3.1 billion of 30 products exported from UK and EU, as the result of their extended dispute over subsidies to Boeing and Airbus.

On Wednesday, the US announced that the Trump administration may impose tariffs on $3.1 billion of 30 products exported from UK and EU, as the result of their extended dispute over subsidies to Boeing and Airbus.

![]() The US Fed announced on Thursday June 25 that it will restrict big banks dividend payment and suspend their share repurchases in the third quarter. This decision came after the annual stress test Fed conducted, which showed some banks would be close to minimum capital levels under the worst coronavirus pandemic scenario.

The US Fed announced on Thursday June 25 that it will restrict big banks dividend payment and suspend their share repurchases in the third quarter. This decision came after the annual stress test Fed conducted, which showed some banks would be close to minimum capital levels under the worst coronavirus pandemic scenario.

![]()

![]()

![]() On Wednesday July 1, China Caixin Manufacturing PMI will be released and is expected to come in at 50.5.

On Wednesday July 1, China Caixin Manufacturing PMI will be released and is expected to come in at 50.5.

![]() US unemployment rate will be released on Thursday July 2, expected at 12.4%.

US unemployment rate will be released on Thursday July 2, expected at 12.4%.

![]()

-0.74*

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 31/05/20

Notice:

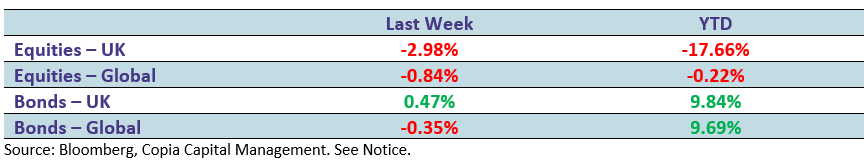

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.