![]()

- Standard & Poor’s, one of the major credit ratings agencies, has declared that Venezuela is in default after it missed a deadline to make $200m in interest payments on two of its government bonds. Venezuelan bond prices have seen relatively large declines on the back of this news, as market participants require higher returns to hold them

- Britain’s annual inflation rate remained unchanged in October standing at 3%. Underlying this number was food prices, which rose at their fastest rate in four years, as the fall in the pound (£) continued to push the cost of living in Britain upwards as we come into the holiday season

- The Norwegian sovereign wealth fund, which has over $1trn in assets, has proposed divesting its investments in oil and gas stocks, stating that the country already has enough exposure to petroleum. Companies that would be effected by this move, such as BP and Shell, fell on this announcement

- During an address at the Lord Mayor’s banquet, Theresa May took aim at Vladimir Putin, accusing Russia of meddling in elections stating they were “deploying its state-run media organisations to plant fake stories and photo-shopped images in an attempt to sow discord in the west and undermine our institutions”

![]()

![]()

- On Thursday 23 November we will see the release of UK GDP YoY, with market participants expecting this to come in around 1.5%

- On Friday 24 November we will see the release of US Manufacturing PMI, with the market expecting a slight increase from the previous month moving up to 55.0

![]() A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

![]() A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

![]() A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 13/11/17

Notice:

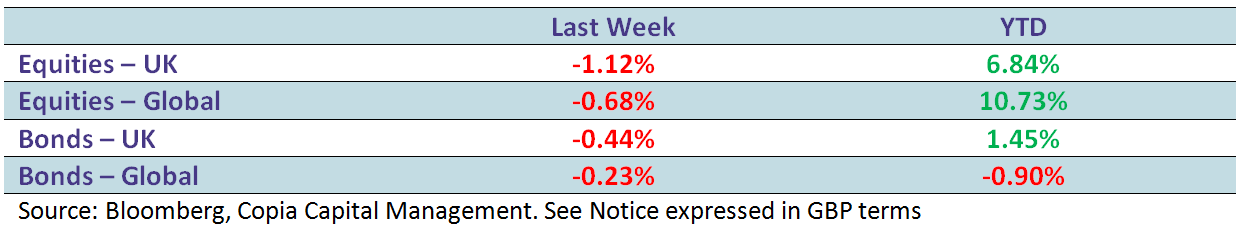

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.