The infoshot to help kick-start your week

Last Week

- As June ends, US Stocks have seen their worst first half-year since 1970: the benchmark S&P Index has fallen 20.6%, alongside other major US indices.

- 10-year US Treasury yield fell on Friday to the lowest level since May, dropping as low as 2.79%, as recession fears leave investors looking for safety.

- Fed’s Mester stated Wednesday that she backs a 75bps rate hike in July, should economic conditions remain as they are now.

- G7 leaders increasingly worried about the complete shutdown of Russian gas. Jeffrey Schott, of PIIE believes this will lead to gas rationing, at least in the short term.

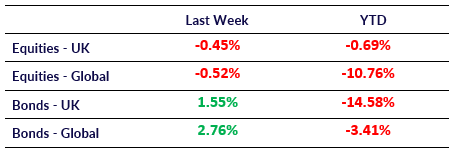

Market Pulse

Coming Up

- US ISM Non-manufacturing PMI (Jun) released 6th July, expected 54.5 (from 55.9).

- German 10-Year Bund auction takes place 6th July, following a previous yield of 1.330%.

- US ADP Nonfarm Employment change published 7th July, forecasted 200k, previously 128k.

Notice:

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.Open document settingsOpen publish panel