![]()

![]() Last week, Microsoft, Apple and Facebook released quarterly earnings reports. Microsoft reported its revenue surging 17% YoY to $43.10 billion, beating the estimates of $40.18 billion. The company’s earnings per share (EPS) also surpassed expectation, standing at $2.03. Apple’s quarterly revenue rose by 21% YoY, landing at an all-time high of $111.44 billion and EPS increased 35% YoY to $1.68, both topping expectations. Facebook’s revenue went up 33% to $28.1 billion and EPS were up 52% to $3.88 compared to the same period last year.

Last week, Microsoft, Apple and Facebook released quarterly earnings reports. Microsoft reported its revenue surging 17% YoY to $43.10 billion, beating the estimates of $40.18 billion. The company’s earnings per share (EPS) also surpassed expectation, standing at $2.03. Apple’s quarterly revenue rose by 21% YoY, landing at an all-time high of $111.44 billion and EPS increased 35% YoY to $1.68, both topping expectations. Facebook’s revenue went up 33% to $28.1 billion and EPS were up 52% to $3.88 compared to the same period last year.

![]() On Tuesday January 26, the International Monetary Fund (IMF) revised its global economic forecasts for 2021, seeing the world economy up by 5.5% in 2021, improved from previous prediction of 5.2% thanks to hopes on global vaccinations and expectations on more stimulus, and it expects the world economy to grow 4.2% in 2022.

On Tuesday January 26, the International Monetary Fund (IMF) revised its global economic forecasts for 2021, seeing the world economy up by 5.5% in 2021, improved from previous prediction of 5.2% thanks to hopes on global vaccinations and expectations on more stimulus, and it expects the world economy to grow 4.2% in 2022.

![]() On Wednesday January 27, the US Fed decided to leave the federal funds rate target range unchanged at 0.00-0.25%. The central bank remained committed to achieving the maximum employment and price stability goals.

On Wednesday January 27, the US Fed decided to leave the federal funds rate target range unchanged at 0.00-0.25%. The central bank remained committed to achieving the maximum employment and price stability goals.

![]() US GDP was published on Thursday January 28, showing a growth of 4% YoY in the fourth quarter of 2020, below the consensus of 4.2%. Consumer spending and private investment contributed to the growth in Q4. The US GDP for the entire year of 2020 however saw a 3.5% contraction due to Covid-19 pandemic.

US GDP was published on Thursday January 28, showing a growth of 4% YoY in the fourth quarter of 2020, below the consensus of 4.2%. Consumer spending and private investment contributed to the growth in Q4. The US GDP for the entire year of 2020 however saw a 3.5% contraction due to Covid-19 pandemic.

![]()

![]()

![]() On Wednesday February 3, China Caixin Manufacturing PMI will be released and is expected to come in at 52.6.

On Wednesday February 3, China Caixin Manufacturing PMI will be released and is expected to come in at 52.6.

![]() US Non-farm payroll employment data will be released on Friday February 5, with an expectation of 55,000 new jobs created for the month of January.

US Non-farm payroll employment data will be released on Friday February 5, with an expectation of 55,000 new jobs created for the month of January.

![]()

+0.70*

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 01/02/21

Notice:

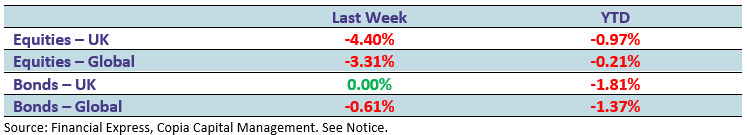

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.