![]()

![]() US has become the epicentre of the Coronavirus Pandemic, with confirmed cases climbing to 245,213 and death toll reaching 5,983 on Thursday April 2. The numbers are likely to get worse according to WHO. Globally, the confirmed coronavirus cases surpassed 1,000,000 on Thursday.

US has become the epicentre of the Coronavirus Pandemic, with confirmed cases climbing to 245,213 and death toll reaching 5,983 on Thursday April 2. The numbers are likely to get worse according to WHO. Globally, the confirmed coronavirus cases surpassed 1,000,000 on Thursday.

![]() The US initial jobless claims figure was released on Thursday, showing a significant increase to a record high of 6,648,000 people amid the Covid-19 pandemic and the non-farm employment figure for March revealed on Friday April 3 dropped by 701,000. The US unemployment rate now stands at 4.4%, 0.6% higher than the expected 3.8%.

The US initial jobless claims figure was released on Thursday, showing a significant increase to a record high of 6,648,000 people amid the Covid-19 pandemic and the non-farm employment figure for March revealed on Friday April 3 dropped by 701,000. The US unemployment rate now stands at 4.4%, 0.6% higher than the expected 3.8%.

![]() The Nasdaq-listed Chinese coffee company Luckin Coffee saw its share price plunge by 76% on Thursday after the company’s chief operating officer Jian Liu was reported and suspended for certain misconduct, including fabricating 2019 sales by about $310mn. The company’s total market value dropped from $6.6bn to $1.6bn in a single day.

The Nasdaq-listed Chinese coffee company Luckin Coffee saw its share price plunge by 76% on Thursday after the company’s chief operating officer Jian Liu was reported and suspended for certain misconduct, including fabricating 2019 sales by about $310mn. The company’s total market value dropped from $6.6bn to $1.6bn in a single day.

![]() The crude oil price jumped on Thursday and Friday as OPEC+ announced an emergency meeting to be held on April 6 to discuss cutting oil production by at least 6 million barrels per day, aiming to stabilise the oil market.

The crude oil price jumped on Thursday and Friday as OPEC+ announced an emergency meeting to be held on April 6 to discuss cutting oil production by at least 6 million barrels per day, aiming to stabilise the oil market.

![]()

![]()

![]() China CPI for March will be announced on Friday April 10, with an expectation of 4.9% YoY.

China CPI for March will be announced on Friday April 10, with an expectation of 4.9% YoY.

![]() US CPI for March will be published on the same day, Friday April 10, with an expectation of 1.6% YoY.

US CPI for March will be published on the same day, Friday April 10, with an expectation of 1.6% YoY.

![]()

+0.19*

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 31/03/20

Notice:

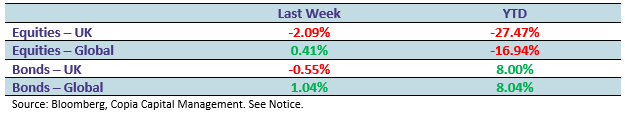

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.