![]()

![]() The latest US Initial Jobless claim was published on Thursday March 26, rising to 3.28m, significantly higher than the estimates of 1.7m and more than four times higher than the previous record of 695k in October 1982. The number is expected to climb for the next few weeks given that the US is still in the early stage of the coronavirus outbreak and lockdown.

The latest US Initial Jobless claim was published on Thursday March 26, rising to 3.28m, significantly higher than the estimates of 1.7m and more than four times higher than the previous record of 695k in October 1982. The number is expected to climb for the next few weeks given that the US is still in the early stage of the coronavirus outbreak and lockdown.

![]() The March Markit Manufacturing and Service PMI for major economies were published last week, showing a historical fall. Eurozone Service PMI plunged to 28.4 compared to the expectation of 39.5. Overall, the Service PMIs dropped more than the Manufacturing PMIs, hitting all-time lows for major economies.

The March Markit Manufacturing and Service PMI for major economies were published last week, showing a historical fall. Eurozone Service PMI plunged to 28.4 compared to the expectation of 39.5. Overall, the Service PMIs dropped more than the Manufacturing PMIs, hitting all-time lows for major economies.

![]() Global confirmed cases for coronavirus increased to over 550k last week. The US saw the infection number jumping to 85.5k, surpassing Italy and China. On Friday March 27, the UK PM Boris Johnson and Health Secretary Matt Hancock were both tested positive.

Global confirmed cases for coronavirus increased to over 550k last week. The US saw the infection number jumping to 85.5k, surpassing Italy and China. On Friday March 27, the UK PM Boris Johnson and Health Secretary Matt Hancock were both tested positive.

![]() On Wednesday March 25, the US Senate passed a $2 trillion stimulus package to subsidise American citizens and businesses impacted by COVID-19 and to increase healthcare resources for hospitals.

On Wednesday March 25, the US Senate passed a $2 trillion stimulus package to subsidise American citizens and businesses impacted by COVID-19 and to increase healthcare resources for hospitals.

![]()

![]()

![]() Eurozone CPI will be announced on Tuesday March 31, with an expectation of 0.8% YoY.

Eurozone CPI will be announced on Tuesday March 31, with an expectation of 0.8% YoY.

![]() US unemployment rate will be revealed on Friday April 3 and is expected at 4.0%.

US unemployment rate will be revealed on Friday April 3 and is expected at 4.0%.

![]()

+0.69*

-1.0 A score of -1.0 indicates an extremely poor economic outlook, which is accompanied by a high probability of negative returns in risky asset classes like equities. The Risk Barometer tilts our portfolios away from equities during such periods.

0.0 A score of 0 indicates a neutral economic outlook with almost equal probability of positive and negative returns in risky asset classes like equities. The Risk Barometer maintains a balance between equities and other asset classes during such periods.

+1.0 A score of +1.0 indicates an extremely positive economic outlook, which is accompanied by a high probability of positive returns in risky asset classes like equities. The Risk Barometer tilts our portfolios towards equities during such periods.

*as at latest realignment 28/02/20

Notice:

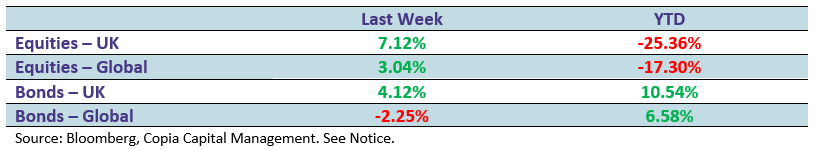

The performance of each asset class is represented by certain Exchange Traded Funds available to UK investors and expressed in GBP terms selected by Copia Capital Management to represent that asset class, as reported at previous Thursday 4:30pm UK close. Reference to a particular asset class does not represent a recommendation to seek exposure to that asset class. This information is included for comparison purposes for the period stated, but is not an indicator of potential maximum loss for other periods or in the future.